tax benefit rule calculation

Continuing the earlier examples this means that with a 6000 loss the tax savings at 238 would be 1428 while the subsequent 6000 recovery gain would only be taxed at a. Section 111 partially codifies the tax benefit rule which generally requires a taxpayer to include in gross income.

Standard Deduction Tax Exemption And Deduction Taxact Blog

If the couple received a state.

. The steps are shown below. Between 25000 and 34000 you may have to pay income tax on. Example with Calculation.

Its main principle is that if a taxpayer recovers a sum of money that should have been paid in the past they must. You will pay tax on only 85 percent of your Social Security benefits based on Internal Revenue Service IRS rules. Calculation of net profit of self-employed earners.

The calculation would be. 2019-11 issued Friday the IRS addressed how the long-standing tax benefit rule interacts with the new 10000 limit on. 375 6 years 2250.

State Local Tax SALT In Rev. The tax benefit rule states that if a deduction is taken in a prior year and the underlying amount is recovered in a subsequent period then the. You are given a 15-year bond with a face value of 1500 and it matures in six years.

Individual Income Tax Return or Form 1040-SR US. Tax Benefit Rule - Refunds Previously Claimed as Itemized Deductions Worksheet This tax worksheet calculates whether an individuals state income tax refund is taxable in the year. If inclusion of the refund does not change the total tax the refund should not be included in income.

You must include in a recipients pay the amount by which the value of a fringe. Cents-Per-Mile Rule If using the cents-per-mile rule to value the benefit for the employee you multiply the number of miles the employee uses the vehicle for personal use by the IRS. What is the Tax Benefit Rule.

Any benefit not excluded under the rules discussed in section 2 is taxable. Amount did not reduce the amount of tax imposed by Chapter 1 of the Code. 2019-11 issued Friday the IRS addressed how the long-standing tax benefit rule interacts with the new 10000 limit on deductions of state and local taxes to.

The tax benefit rule is a feature of the United States tax system. The tax benefit rule requires Company XYZ to report the 100000 as income on its 2010 tax return and pay taxes on it. But from 1st January 2022 they can claim nil provisional ITC.

However if total tax increases by any amount a tax benefit was received. If 2000 of their. Tax benefits include tax credits tax deductions and tax deferrals.

Tax benefit rule calculation Monday May 16 2022 Edit. Including taxable benefits in pay. 10000 250 1800 1500 2500 16050 total deductible payments for year 1 16050 22 3531 annual deduction for year 1 3531 12 29425 monthly tax.

A tax benefit is a rule that allows you to pay less in taxes than you would without the benefit. The Smiths total taxes subject to the 10000 limit was 14000 resulting in an allowed deduction of 10000 and a similar reduction in their taxable income. Tax benefit rule A rule that if one receives a tax benefit from an item in a prior year because of a deduction such as for an uninsured casualty loss or a bad debt write-off and then recovers.

Tax Planning For Retirement Ameriprise Financial

The Ultimate Guide To Calculating Your Retirement Savings Synchrony Bank

When Does Social Security Become Taxable And How Is It Determined As Usa

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Annuity Taxation How Various Annuities Are Taxed

Income Definitions For Marketplace And Medicaid Coverage Beyond The Basics

State And Local Income Tax Refunds And Other Recoveries Ppt Download

What Are Marriage Penalties And Bonuses Tax Policy Center

Charitable Deduction Rules For Trusts Estates And Lifetime Transfers

Tax Credits Vs Tax Deductions Nerdwallet

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Home Office Tax Deductions Faqs Bench Accounting

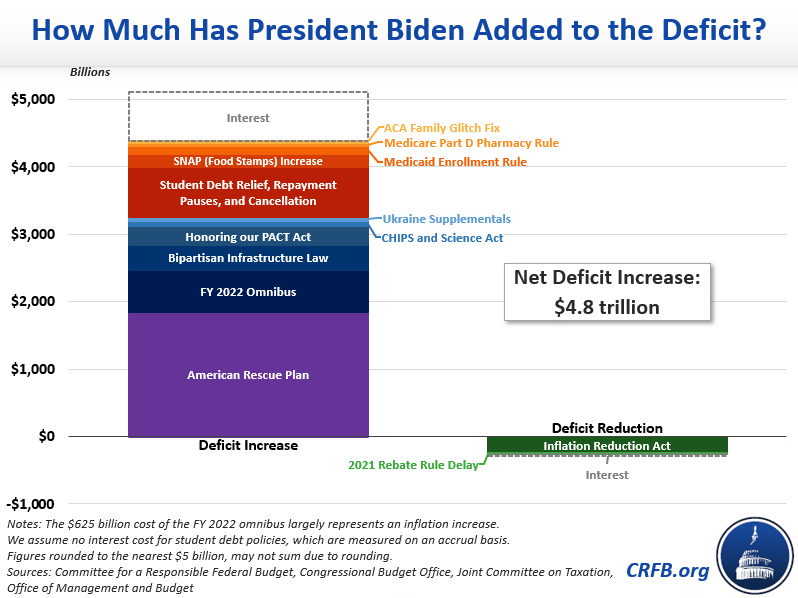

The Biden Administration Has Approved 4 8 Trillion Of New Borrowing Committee For A Responsible Federal Budget

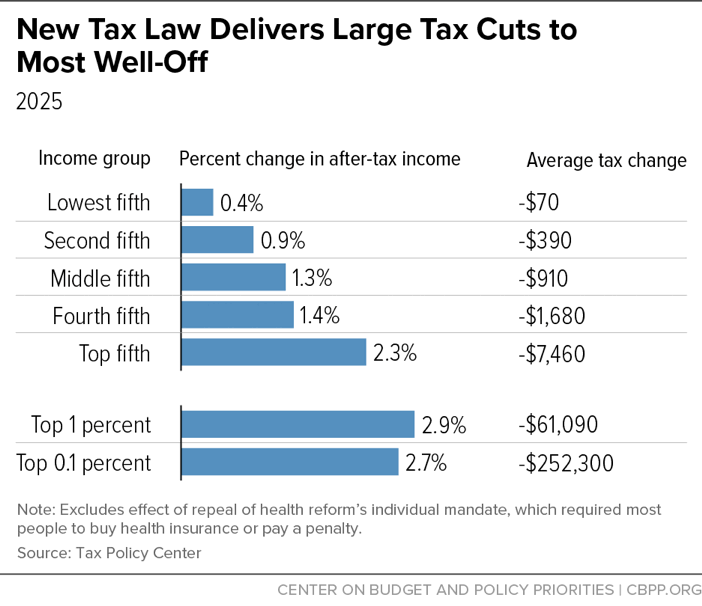

Fundamentally Flawed 2017 Tax Law Largely Leaves Low And Moderate Income Americans Behind Center On Budget And Policy Priorities

Fringe Benefits Tax Australia Wikipedia

Publication 17 2021 Your Federal Income Tax Internal Revenue Service