flow through entity llc

An LLC is considered a pass-through entityalso called a flow-through entitywhich means it pays taxes through an individual income tax code rather than through a. As a result only these individualsand not the entity itselfare taxed on the revenues.

:max_bytes(150000):strip_icc()/LLC1-18d57e4a3ac44dccad4562e536e71cd7.jpg)

What Is An Llc Limited Liability Company Structure And Benefits Defined

Flow-through entities are different from C corporations they are subjected to single taxation and not double taxation.

. Instead that income passes through or flows through to the owners and is. Updated November 25 2020. Instead it is what the IRS calls a pass-through entity like a partnership or.

An LLC that chooses to be taxed in this way will have its. However the late filing of 2021 FTE returns will be. LLC flow-through is a business structure that passes the profits losses credits and expenses to the owners of the company.

This means that when a company is unable to pay a debt the personal property of the LLC members such as homes and cars are shielded from the creditor. A flow-through entity FTE is a legal entity where income flows through to investors or owners. Unless the owners of the LLC file paperwork to change the companys tax status the.

Where a single member LLC. There are three main types of flow-through entities. A limited liability company LLC is not a separate tax entity like a corporation.

The protection of personal. Is an LLC a flow-through entity. Thereof are LLC flow through entity.

A flow-through entity is also called a pass-through entity. LLC Income Tax Overview. Generally business owners like flow-through entities because.

With that said the LLC isnt a separate tax entity. Flow-through entities are a common device used to avoid double taxation which happens wit See more. Therefore LLC owners cant be held personally liable for the debts and obligations of the business.

Excluding sole proprietorships which receive just 4. Tax purposes and accordingly its operations are reported on the members individual tax return. While the default tax treatment for an LLC is pass-through taxation owners may elect to be taxed as C corporations.

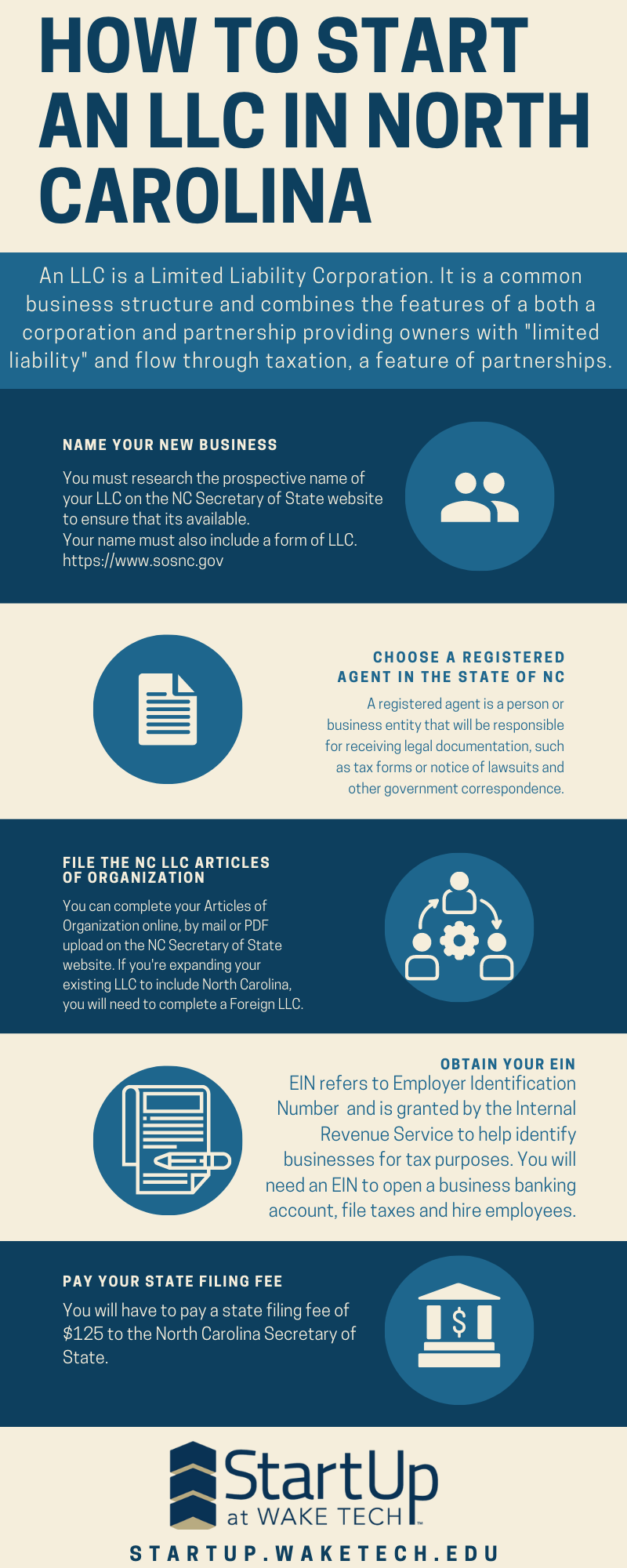

A flow-through entity is a legal business entity that passes any income it makes straight to its owners shareholders or investors. The business format provides owners a. A single member LLC is considered a disregarded entity for US.

2021 Flow-Through Entity FTE annual return payments must be made timely to avoid penalty and interest. A pass-through entity allows a lot of flexibility because LLC owners can choose how their business will be taxed and still retain the benefits of a flow-through entity. Structuring the admission of the service provider.

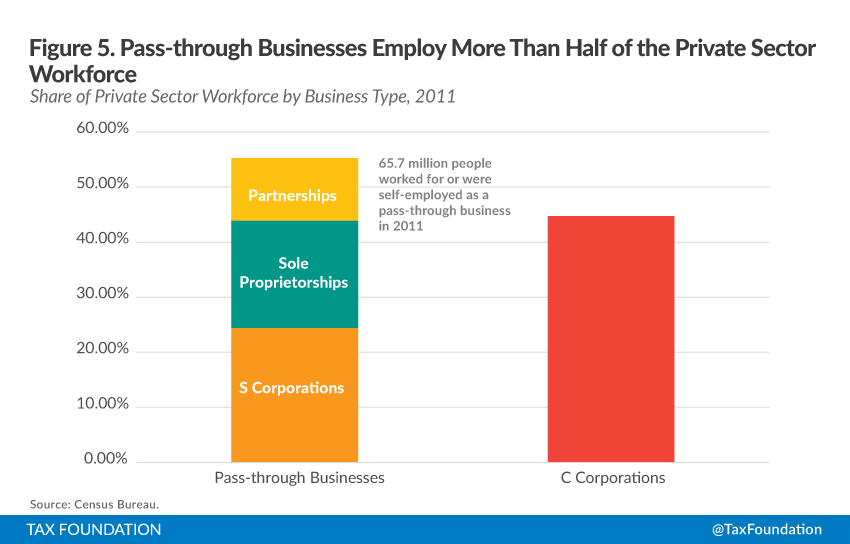

Structuring the Flow-Through Entity. The share of business activity represented by flow-through entities has been rising since the passage of the Tax Reform Act of 1986. That is the income of the entity is treated as the income of the investors or owners.

Limited liability companies LLCs are pass-through entities by default. In a pass-through entity also knows as a flow-through entity business income isnt taxed at the company level. Using qualified S corporation subsidiaries and single-member LLCs.

Types of flow-through entities. The business income is taxed once instead of twice as in the case of C-Corporations. A business owned and operated by a single individual.

Business Entities Pros And Cons You Should Know As A Freelancer Upwork

The Other 95 Taxes On Pass Through Businesses Econofact

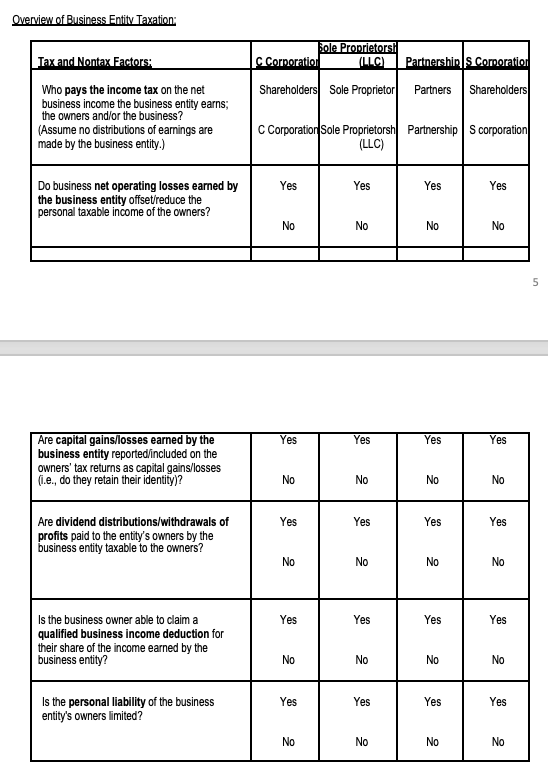

How To Register An Llc In North Carolina Wake Technical Community College

What Is A Disregarded Entity Llc Llc University

What Is A Passthrough Entity Universal Cpa Review

What Is A Pass Through Entity Northwest Registered Agent

What Is A Pass Through Business How Is It Taxed Tax Foundation

Know The Basics Llc Advantages Disadvantages Justworks

An Overview Of Pass Through Businesses In The United States Tax Foundation

Pass Through Entity Definition Examples Advantages Disadvantages

New Guidance And Election Application For Optional Pass Through Entity Tax Dermody Burke Brown Cpas Llc

Llc Tax Calculator Definitive Small Business Tax Estimator

Llc Vs Corporation What Is The Difference Between An Llc And A Corporation Mycorporation

What Is A Pass Through Entity Youtube

How To Choose Your Llc Tax Status Truic

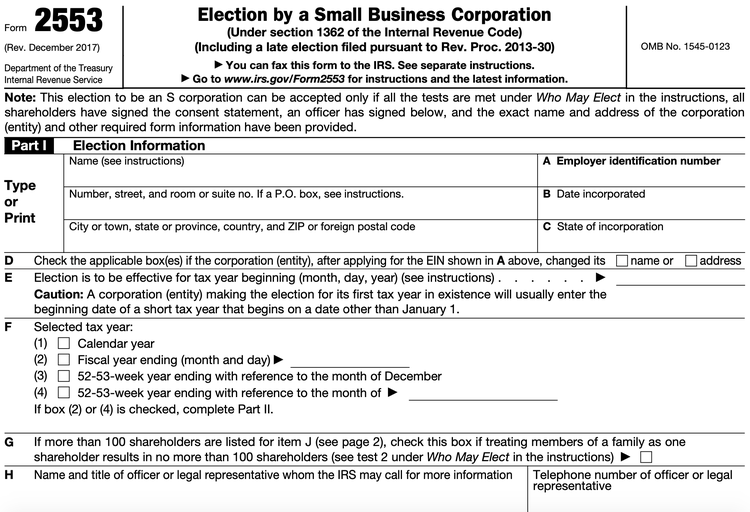

C Corp Vs S Corp Partnership Proprietorship And Llc Toptal