how to lower property taxes in texas

Each county taxing unit multiplies the taxable value by the taxing units tax rate to determine their share of the property tax collected. File a property tax protest State laws allow you to file a protest against high property tax if you believe them to be unfair.

Why Are Texas Property Taxes So High Home Tax Solutions

Just like in 2015 this increase in the homestead exemption will lower the amount of your homes value subject to school taxes the largest share of property tax bills.

. CAD taxable values are as follows. Counties in Texas collect an average of 181 of a propertys assesed fair market value as property tax per year. Look for local and state exemptions and if all else fails file a tax appeal to lower your property tax bill.

Today businesses pay property taxes on. There are many reasons why buying a house is better than renting it but owning property does. Prepare information for hearing.

Rising Property that Makes Lower Property Taxes in Texas Harder. However if you are an individual over the age of 65 you have options to help alleviate the burden of high property taxes. This is important because the process can be arbitrary.

If you fight to lower your taxes every year you have a greater chance of significantly reducing your taxes. File a Notice of Protest. 2 days agoWhy are property taxes in Texas so high.

Plus since there are several ways your appeal can get thrown out and lots of heady math involved a tax attorney can help you figure out whether you have a caseand help you win it. Add all of the taxing units dollar amounts to determine your total tax bill. If your home is valued at 75000 for example but you have a 10000 exemption you are only taxed on the new value 65000 75k 10k exemption.

But the bill is currently stuck in committee. The steps below will show you how to lower property taxes in Texas so you can move forward with your appeal. If approved Proposition 2 will save.

Here are some ideas to get your appraisal and your property taxes. Appeal through district court or arbitration. Learn How Property Tax Assessment Works.

File a notice of protest. Give the assessor a chance to walk through your homewith youduring your assessment. Property taxes are one of the major funding sources for Texas public schools.

Therefore check the following items. Appeal your property taxes EVERY YEAR. 19 hours agoThis follows an increase in the homestead exemption which I also co-authored and the voters approved in 2015 from 15000 to 25000.

Check if you are eligible for tax exemptions under homestead laws and notify your county assessors office to reduce property tax. Each countys appraisal district appraises properties and determines their. For individuals 65 and older in Texas there is no way to freeze all property taxes.

The median property tax in Texas is 227500 per year for a home worth the median value of 12580000. For example there are five homes on your block that are similar in age size and amenities. Assessed value minus exemptions taxable value.

One of the ways to lower your property taxes in Texas is to qualify for any one of the different exemptions available. The formula they use follows. The first proposition would draw down property taxes for elderly and disabled Texans by reducing the amount they pay to public schools which typically makes up most of a homeowners tax bill.

Governor Abbott also announced on Monday his proposal to lower property taxes on small businesses. Attend an informal hearing at the Appraisal District office. We have formed relationships with the appraisal districts we have state of the art computer programs and do the research needed to get you the lowest possible value.

Requiring local governments to provide a 3 discount to homeowners who pay their property taxes in full prior to the. Without one the cap would be 10. Tax Code Section 1113b requires school districts to provide a 25000 exemption on a residence homestead and Tax Code Section 1113n allows any taxing unit to adopt a local option residence homestead exemption of up to 20 percent of a propertys appraised value.

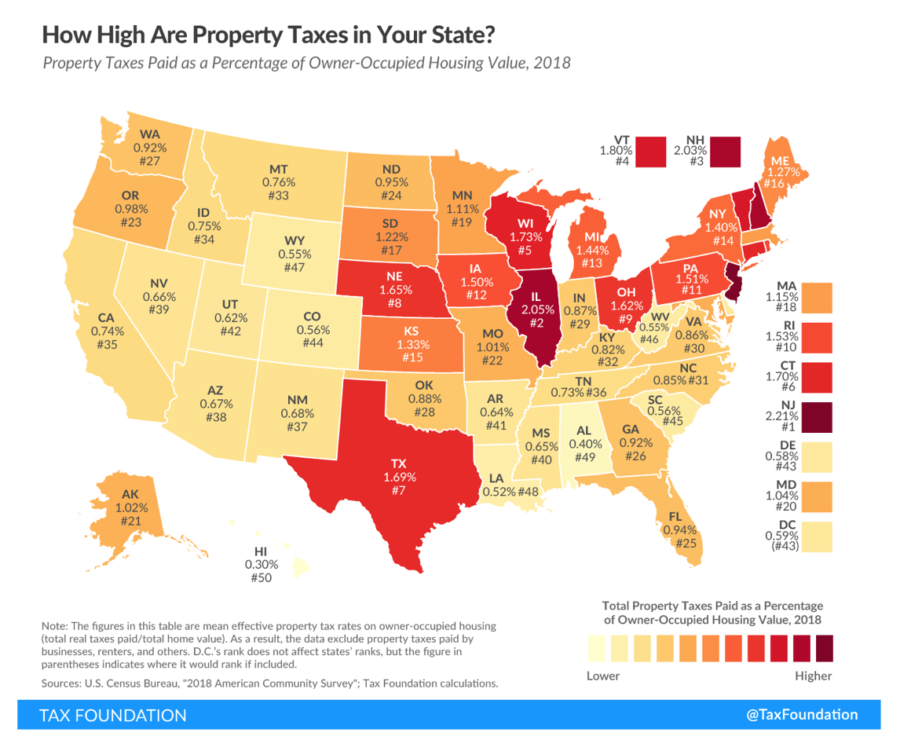

Tax amount varies by county. House Bill 3 was an 116 billion school finance bill that included 51 billion to lower school district taxes 65 billion in. Due to the absence of state income taxes and a substandard sales tax of approximately 825 most of the revenue earned by the state has to be generated through property taxes.

If your jaw hit the floor when you opened yours you should protest your homes market value with your county appraisal district. Fight Hard To Have Your Tax Value Reduced. In Texas there are ways to lower property taxes through exemptions because of the high property tax rate in the state.

That legislation would limit the amount an appraisal could jump in a year to 5 if you have a Homestead Exemption. Appeal to the highest level that is financially feasible. That would begin Jan 1 2022.

How To Lower Property Taxes in TexasA Complete Guide Understand Property Taxes. Texas voters will decide whether to lower their property tax payments after Legislature completes last-minute Hail Mary If voters approve the measure next year it will raise the states homestead. 181 of home value.

Attend an Appraisal Review Board hearing. Proposition 2 would increase the homestead exemption Texans can take on their school district property taxes from 25000 to 40000. Every state has slightly different rules and regulations for property tax protests.

Texas has one of the highest average property tax rates in the country. This money is used in paying for and providing important services to Texas residents such as schools. Paul Bettencourt R-Houston.

Analysis Texas Government S Favorite Local Tax

/https://static.texastribune.org/media/files/e6a25cb17ab2c3572ed710eb3748ddc0/Housing%20North%20Austin%20AI%20TT%2007.jpg)

Analysis Texas Property Tax Cut Measure Passed With The Long Game In Mind The Texas Tribune

Over 65 Property Tax Exemption In Texas

/https://static.texastribune.org/media/files/4cb5621a1321941aca5f8d0b30d6a83b/share-art.png)

How Do Texas Governments Calculate Your Property Taxes Here S A Primer The Texas Tribune

Texas Property Tax Trends Informal Hearing Reduction

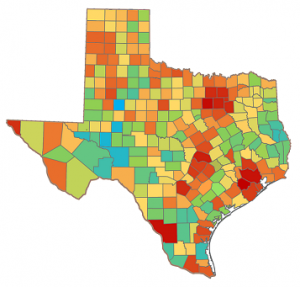

Tac School Property Taxes By County

Reduce Texas Soaring Property Taxes By Embracing Sound Budgeting

Tac School Property Taxes By County

Property Taxes In Texas What Homeowners Should Know

Texas Voters Will Decide Whether To Lower Some Property Tax Bills In May Election

Title Tip Another Legislative Update For Texas Homeowners Candysdirt Com

Texas Property Tax Protest Tips Learn To Reduce Taxes

/https://static.texastribune.org/media/files/3e5928e601d8b67d71acf4b04526cd06/Aerial%20Suburbs%20JV%20TT%2001.jpg)

/https://static.texastribune.org/media/files/7eaf54967fd9e1e99018c3430a2e7340/Aerial%20Suburbs%20JV%20TT%2002.jpg)